chaofann

Co-produced by Austin Rogers

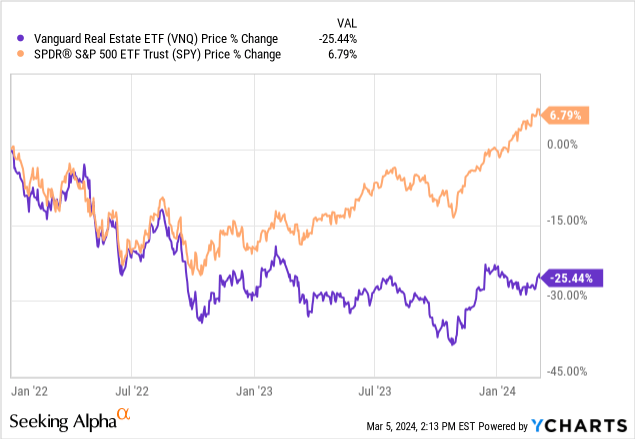

Right now, the prevailing consensus in the market seems to be that commercial real estate (“CRE”) and the publicly traded real estate investment trusts (“REITs”) (VNQ) that own it are permanently impaired. Property values are falling, and high interest rates have made CRE business models unviable.

That’s the narrative.

SL Green

But as is so often the case, this popular narrative takes a kernel of truth and blows it out of proportion into huge misconceptions.

That’s when it’s helpful to hear from a real expert in the field, such as a portfolio manager at Blackstone (BX), the largest alternative asset management company in the world.

In what follows, we look at what a top CRE expert at Blackstone has to say about the sector today. It’s true that he’s talking up Blackstone’s book of business, but Blackstone is not bullish about all sub-sectors of CRE.

There is a “generational buying opportunity” in CRE right now, but you have to know where to look.

Blackstone Thought Leader Is Selectively Bullish On Real Estate

In a recent Bloomberg TV interview, Blackstone’s Global Co-Head of Real Estate, Nadeem Meghji, articulated the case for commercial real estate as a deep value opportunity.

If you take a step back, we’ve had two really difficult years for commercial real estate, and there are really two reasons for that. One of those is a historic increase in rates, which put downward pressure on valuation multiples for real estate. The other thing that’s happened is that office buildings have faced a lot of pressure. The combination of that has been negative headlines and negative sentiment.

Meghji says that sentiment surrounding CRE will probably continue to be negative because there will be more negative headlines about banks and investors who made CRE investments during the ultra-low interest rate era who are now faced with refinancing in a much higher interest rate environment.

“But from our perspective,” says Meghji, “that’s all priced into asset values today.”

Meghji goes on to say (emphasis added):

And in fact, when we look forward, we see something very different. What we see is a generational buying opportunity while others are looking in the rearview mirror.

And the reason for that is #1 interest rates. Inflation is cooling, rates have come down from their October highs from last year, and credit formation is once again happening in real estate. All-in borrowing costs are down 200 basis points over the last five or six months.

There’s a lot to unpack here.

First, on inflation, note that inflation is cooling in a major way. In fact, if you exclude the lagging shelter component of the CPI and PCE metrics, inflation has already been back under the Fed’s 2% target for over half a year.

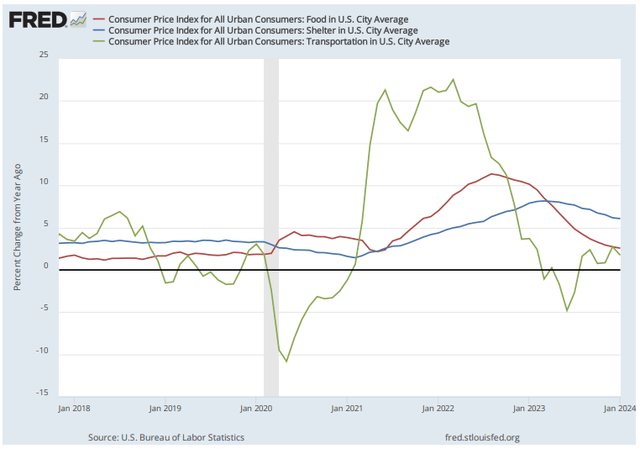

Below you can see the year-over-year CPI components of shelter (blue line), food (red line), and transportation (green line), which together make up about 2/3rds of the CPI by weighting.

St. Louis Fed

Overall food and transportation inflation are back to pre-pandemic levels, while shelter inflation of about 6% YoY is backward-looking, smoothing out the sharp rent hikes over the last few years but failing to show today’s rent changes that are flat or slightly negative.

Today’s flat or slightly down residential rents (which shelter CPI tracks more closely than housing prices) will eventually filter into shelter CPI, which will allow the headline and core inflation metrics to fall further.

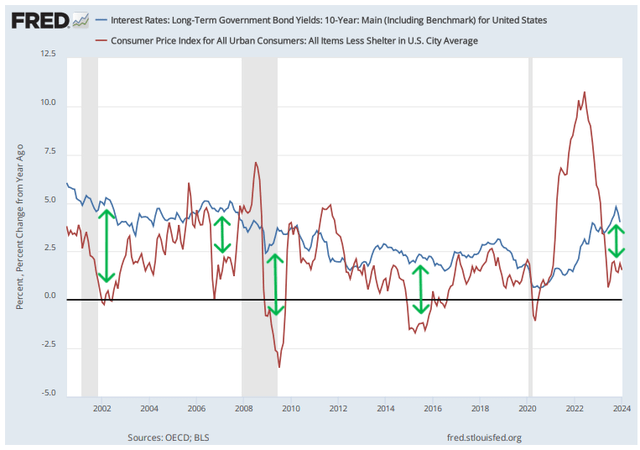

If you compare the 10-year Treasury yield to CPI ex shelter, the gap between the two has rarely been as wide as it is now, and usually these gulfs result in a falling 10-year rate in the years after.

St. Louis Fed, modified by author

This is an important point because long-term interest rates typically follow inflation. When the market sees inflation as high and likely to stay high or go higher, interest rates rise. But when the market sees inflation as low and/or falling, interest rates usually fall.

This positive outlook on inflation is also good news for interest rates, which should also decline in the coming years.

Declining interest rates should, in turn, reverse the falling property values in CRE and spur a resurgence in credit formation and lending in the CRE space. It should also cause REIT valuation multiples to increase and lower their cost of capital, allowing them to increase acquisition volume and portfolio growth again.

That is why certain CRE and select REITs, which have massively underperformed the market over the last few years, are a generational buying opportunity today.

The market is pricing REITs as if interest rates were going to stay this elevated forever. But that is highly unlikely to be the case.

Another critically important point raised by Meghji concerns supply.

We all know that the fundamental determinant of prices in the economy is the balance of supply and demand. That goes in CRE as well, including for rent rates and property prices.

That is why it is so important to observe that, while there is a slew of new CRE properties hitting the market right now because of conditions that existed a few years ago, supply is inevitably going to plunge in 2025 and beyond due to the steep fall-off in new construction today.

To quote Meghji:

The other thing that’s happening that is underreported is this idea of new construction, which is down 30-70% in our core sectors versus two years ago. That, in the medium term, will lead to a sharper recovery than the market likely expects.

We can observe the severity of this continued drop in CRE construction in a number of ways.

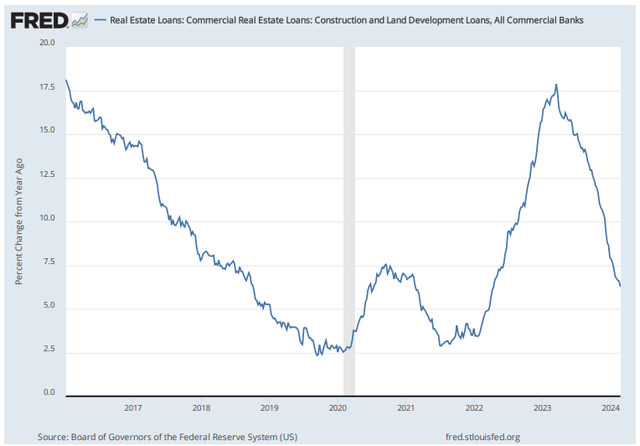

First, consider that the growth in bank lending for CRE construction and land development purposes has plunged from its early 2023 peak:

St. Louis Fed

In most cases, without a construction loan, new CRE properties simply aren’t getting built.

Note that the chart above does not adjust for inflation or the rise in construction costs over the past several years.

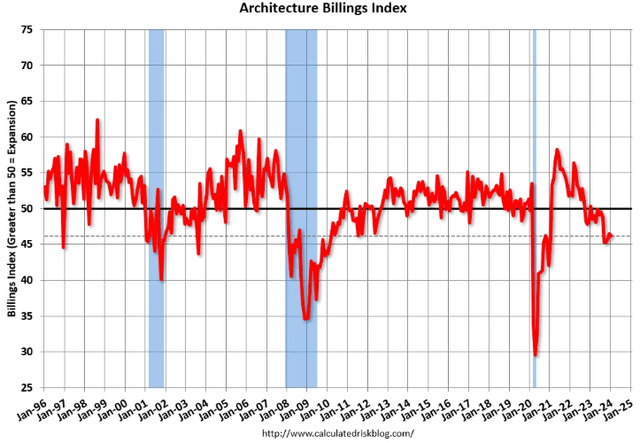

Second, the architecture billings index currently sits at recessionary levels.

Calculated Risk

Every newly constructed building requires an architect to design it. Fewer architect orders necessarily mean fewer new buildings.

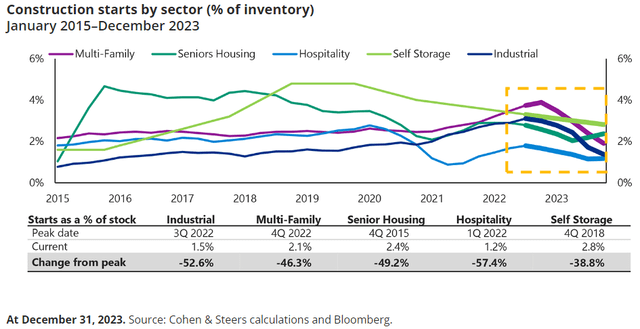

Finally, we can directly measure development starts for various sectors of CRE to see that most of them have dropped significantly from their post-COVID peaks.

Cohen & Steers

In particular, multifamily, industrial, and senior housing remain at significantly below-average levels. This will inevitably translate into less new supply being delivered in 2025 and beyond.

The final point from Meghji we want to highlight is that selectivity is crucial.

Says Meghji:

Where you invest matters. There’s a huge bifurcation across asset classes. We all know what’s happening with office. Values are under pressure, rents are under pressure. In fact, US office represents only 1.5% of our global portfolio, because we were nervous about office.

On the flipside, look at data centers, which are our fastest growing asset class: 2% vacancy, 25% rent growth, 10 times the demand we saw only 5 years ago, and the AI revolution is just getting started.

Costar

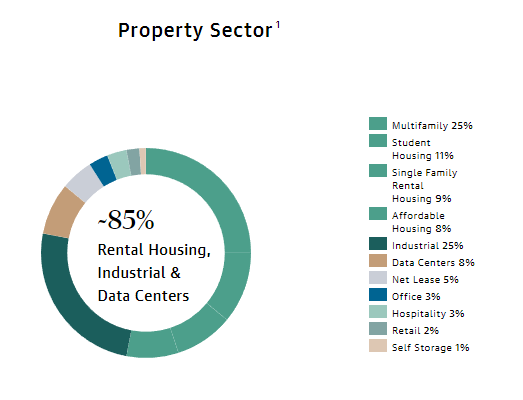

Although data centers may be the fastest growing part of Blackstone’s flagship private real estate fund, BREIT, there are two other CRE sectors with larger weightings. Here’s the portfolio breakdown from BREIT’s website:

BREIT

As you can see, while data centers are a small and fast-growing part of the BREIT portfolio, Blackstone is far more heavily concentrated in residential rental housing and industrial properties.

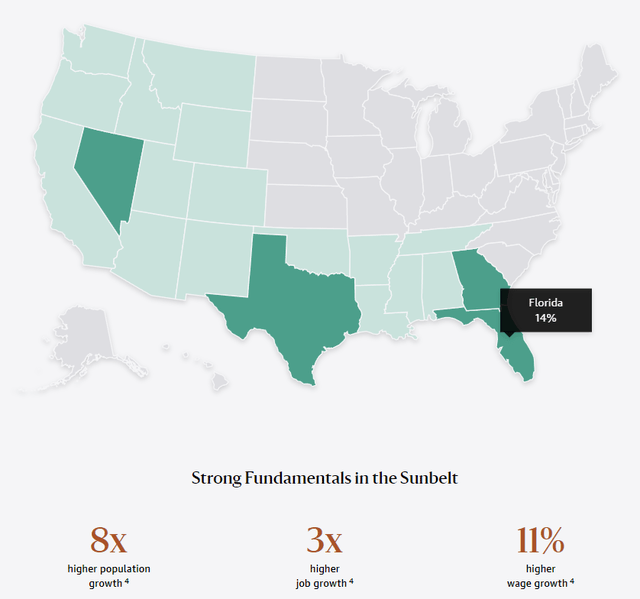

Also, portfolio geography matters to the performance of CRE properties. That is why BREIT is heavily concentrated in Sunbelt states with its four largest states by weighting being Florida, Georgia, Texas, and Nevada.

BREIT

BREIT’s particular mix of Sunbelt states have enjoyed 8x faster population growth, 3x faster job growth, and 11% higher wage growth than the national average.

Takeaway For REIT Investors

While we are by no means pitching Blackstone’s private investment products because there are better opportunities among publicly listed REITs, we think it would be a bad idea to ignore what Blackstone is doing and where they are investing in the CRE space.

We think this is highly relevant information for public REIT investors.

After all, Blackstone has about $65 billion in dry powder earmarked for investment in the CRE space, and the asset manager has established a track record of take-private acquisitions of REITs at high premiums.

We don’t advocate buying REITs simply because they might be buyout targets for a big PE investor like Blackstone. But we do think it is a good idea to acknowledge Blackstone’s expertise in the CRE space and look for undervalued yet high-quality REITs that invest in the same spaces. At the very least, they probably have similarly strong organic growth, and at most, they could become buyout targets.

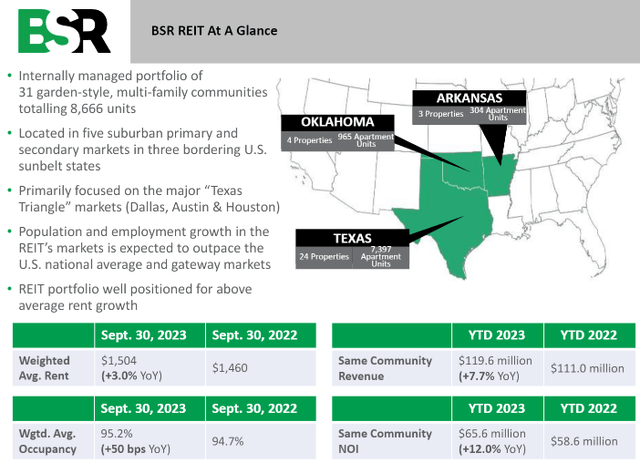

For example, one of our favorite REITs is a small and relatively unknown Sunbelt multifamily landlord called BSR REIT (OTCPK:BSRTF).

Over 90% of the REIT’s rent comes from Texas, one of the fastest growing states in the country, and the majority of BSR’s suburban, Class B apartments are located in the “Texas Triangle” of Houston, Dallas/Fort Worth, and Austin.

BSR November Presentation

BSR trades at a steep discount to its net asset value (“NAV”). At the end of Q3 2023, its NAV per unit stood at $18.66. Assuming NAV per unit stayed flat QoQ, BSR currently trades at a discount to NAV of about 40%. But even if BSR’s NAV per unit slid 10% QoQ (which may be too aggressive of an assumption), its stock price would still be listed at a roughly 35% discount to NAV.

BSR offers a well-covered 4.7% dividend yield, solid organic growth, a well-aligned management team, and it certainly looks like an appealing buyout candidate for the likes of Blackstone.

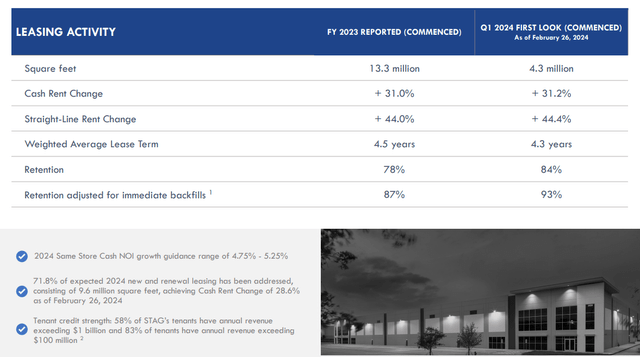

When it comes to Blackstone’s second largest CRE sector, industrial, one of our favorite picks is STAG Industrial (STAG), owner of industrial logistics properties in largely secondary and tertiary markets across the country.

STAG’s ~16x FFO multiple is quite low compared to peers like Prologis (PLD) at ~24x, EastGroup Properties (EGP) at ~22x, and First Industrial Realty Trust (FR) at ~20x. This factor alone surely makes STAG a more interesting buyout prospect for the likes of Blackstone.

But even if STAG is never acquired by anyone, consider the strength of the REIT’s organic growth.

STAG February 2024 Presentation

Last year was red-hot for all industrial REITs, including STAG. Perhaps more impressive is the fact that STAG’s performance into 2024 has not slipped from its strong showing in 2023. If anything, the portfolio is performing slightly better, with tenant retention increasing and immediate backfills of newly vacant space also up.

This is remarkable strength, and it explains how STAG can project same-store cash NOI growth of ~5% this year even as headlines highlight the slowdown in industrial leasing and rent growth.

Bottom Line

The death of commercial real estate has been greatly exaggerated.

Blackstone knows that, which is why they are doubling and tripling down on their favorite areas of CRE. And their expertise should not be ignored, in our view.

We may not invest in Blackstone funds, but we, like them, want to invest in the most attractive types of CRE with the fastest growth and greatest upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.