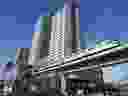

TransLink’s proposal to build a 30-storey mixed-use project with local development firm PCI follows in the footsteps of agencies such as Hong Kong’s Mass Transit Railway

Article content

TransLink’s foray into real estate development to help finance its ambitious multibillion-dollar expansion plans is an idea that has “been needed for decades” in Metro Vancouver, according to one planning expert.

“Especially now when so much additional housing is hinged on transit,” said Andy Yan, associate professor and director of Simon Fraser University’s City program.

Advertisement 2

Article content

Using property development to finance transit isn’t a new concept, Yan said. Hong Kong and its Mass Transit Railway is probably the most famous contemporary example of an agency that has a real estate division aimed at building housing that is supported by the transit system.

TransLink’s first try at real estate development, a proposal with local developer PCI to build a 30-storey mixed-use tower adjacent to the future Arbutus Subway Station, recently sailed through a public hearing at a Vancouver city council meeting.

For TransLink, the development is part of the agency’s efforts to “leave no stone unturned when it comes to generating new revenues” to finance its ambitious Transit 2050 capital plan, CEO Kevin Quinn said in a statement.

The capital plan is woefully short of stable funding. Approval of the proposed development at the intersection of Broadway and Arbutus came a day after TransLink dropped a bombshell warning about the services that it would have to cut if it can’t fill a nearly $600 million annual operating shortfall.

Yan, however, said there’s an inherent tension between TransLink’s need for revenue and society’s bigger-picture needs.

Article content

Advertisement 3

Article content

“In one instance, are we talking about a stream of revenue to support the transit system?” Yan said. “(Or) attention to the provision of affordable housing? Those aren’t necessarily the same thing.”

The project is located at the western boundary of the Broadway Plan, the city’s blueprint for transforming the corridor into a “second downtown” and along which the city is under pressure to provide affordable housing to accommodate the displacement of longtime renters.

TransLink and PCI’s development proposal includes below-market-rate units, which were singled out during the July 25 public hearing that saw the project receive a unanimous vote of council.

The project’s plans include 260 new rental apartments — 200 market-rate units and 60 below-market units for moderate-income families — as well as street-level retail units and space for the Ohel Ya’akov Community Kollel Jewish cultural centre.

Coun. Rebecca Bligh praised the project during the hearing, saying “there’s a lot of benefits” to the proposal, including the large number of units it’s proposing to provide, especially below-market units that won’t displace any existing renters.

Advertisement 4

Article content

“It’s going to help us deliver on the (tenant relocation) that we’ve committed to with the Broadway Plan,” Bligh said. “It’s not a silver bullet, it’s not a perfect solution, but we have to keep pushing on where we can to find sites that do not have displacement.”

Yan, however, said some of the definitions of below-market rents used in incentive schemes for affordable housing don’t necessarily provide units for people who need them most, especially those who are reliant on transit.

Some of Vancouver’s rental incentives peg non-market rents at 20 per cent below market rates, but “20 per cent off extremely unaffordable is still unaffordable,” Yan said. “Especially on local working incomes.”

TransLink outlined the objectives of its real estate development investment fund in its 2022 Investment Plan. At a high level, the agency seeks to “leverage its existing property assets and funds to generate non-fare, non taxation revenue” to support its regional growth strategy.

Proceeds from the sale of surplus property will be applied to a revolving land fund, which will be used to make future land acquisitions and development.

Advertisement 5

Article content

TransLink said it expected to use $135 million from the revolving fund to acquire land for capital projects in 2022-2024, while also returning $30 million to TransLink for operating revenue.

Yan, however, said TransLink winds up being at a disadvantage for future acquisitions when they’re on the open market “competing with other deep-pocketed private developers.”

Looking at Hong Kong again, Yan said the Mass Transit Railway has sought to acquire property before making and announcing big decisions on where new lines or stations would be located. Here, however, governments tend to lay out their plans, along with station locations, first.

“Hong Kong defines the market or they define the game,” Yan said. “In Metro, TransLink has to play the game. It’s very different consequences when you’re playing the game as opposed to defining the game.”

Recommended from Editorial

-

Transit riders advised of service disruptions on SkyTrain Canada Line

-

TransLink says its cut of $1.6B in federal infrastructure money not enough to fill funding gap

Bookmark our website and support our journalism: Don’t miss the news you need to know — add VancouverSun.com and TheProvince.com to your bookmarks and sign up for our newsletters here.

You can also support our journalism by becoming a digital subscriber: For just $14 a month, you can get unlimited access to The Vancouver Sun, The Province, National Post and 13 other Canadian news sites. Support us by subscribing today: The Vancouver Sun | The Province.

Article content